OCR technology optimizes workflow in the insurance industry

2022-10-09 10:31:20Application Background

The CBIRC issued the Measures for the Administration of the Real-Name System of Personal Insurance, making it clear that natural persons, as policyholders, insured persons and beneficiaries, are required to conduct real-name checking and recording when handling the business of taking out insurance, restoring the validity of the personal insurance contract, approving changes to the policy, pledging a loan for the policy, surrendering the policy, and settling a claim.

How many steps are there in total for the key authenticity check in the personal insurance real-name system?

In the first step, insurance companies and insurance intermediaries, as the responsible parties for real-name information checking, should require policyholders, insured persons and beneficiaries to provide valid identity documents, verify the authenticity and validity of the identity documents, and ensure that the person's identity card matches.

For off-site methods such as the Internet, the Measures also explicitly require relevant insurance companies and insurance intermediaries to verify the authenticity and validity of the identity documents of the policyholders, insured persons and beneficiaries through effective technical means, and to ensure that the identity documents are consistent with each other.

In the second step, after verification, the insurance company and insurance intermediary will upload the name, type of identity document, document number, validity period and other information of the policyholder, insured person and beneficiary to the insurance real-name checking and registration system for information authenticity checking in a timely manner in accordance with the provisions of different insurance businesses.

In the third step, after receiving the information uploaded by the insurance company and the insurance intermediary that is docked with its real name, the insurance real name verification registration system will check the authenticity of the information with the relevant national databases and feedback the results of the verification to the insurance company and the insurance intermediary.

If the result of the verification is untrue, the insurance company or insurance intermediary shall not apply for insurance business for the policyholder, insured person or beneficiary. The Measures also stipulate that if the policyholder, insured person or beneficiary has used false identity documents, fraudulently used another person's name or provided false information, etc., they will be included in the list of record of breach of trust behavior.

User Pain Points

Cumbersome entry of policyholder information

In this context, we in the insurance industry for a variety of businesses have to provide valid documents for the insurance agency to verify the insurance salesman in the verification of the basic information of the policyholder, the traditional way of insurance for: account managers in the field manually enter a variety of documents provided by the customer information, the amount of information entry for a customer to be more than 30 minutes, the staff to enter the document information is time-consuming and laborious, there are also entry errors It takes more than 30 minutes for a customer to enter the information, and it is time-consuming for the staff to enter the information, and there are also cases of errors in entering the information, which seriously affects the customer satisfaction and reduces the sales of insurance!

Long Claim Settlement Time

After the claim materials (including ID card/bank card/medical documents) are submitted to the insurance company, the salesman needs to manually check the information and enter it into the business system, which leads to a long claim cycle. In the Internet era, many of our businesses have been transferred to online processing, but whenever the customer handles the business, they have to enter their own document information, which decreases the customer experience and ultimately results in the loss of customers.

The Solution

The APP side and server side of the insurance industry integrates Vantone's OCR document recognition and bank card recognition technology, which provides second-level recognition speed and ultra-high recognition accuracy, helping the financial and insurance industries to improve the efficiency of information entry, increase the time efficiency of business processing, and enhance customer satisfaction.

Mobile OCR technology

Document Recognition:

Automatically capture document information (e.g., name, ID number, etc.) by shooting document images.

Supporting a wide range of documents: recognition of 18 commonly used domestic documents such as second-generation ID cards, driving licenses, passports, Hong Kong and Macao Travel Permits, hukou books, etc., and at the same time, it can increase the number of document types according to the needs of customers.

Supporting the recognition of both video streaming and photo taking modes.

Support Android and iOS platforms. (plus document images)

Bank card recognition:

Automatically collect bank card information (e.g., card number, attribution bank, etc.) by taking bank card images.

Supporting the recognition of domestic general-purpose bank cards, such as letterpress cards, platform cards and vertical cards.

Supporting the recognition of both video streaming and photo taking modes.

Support Android and iOS platforms. (plus bank card images)

Business card recognition:

Automatically collects business card information (e.g. company name, phone number, name, etc.) by taking images of business cards.

supporting horizontal and vertical business cards and other kinds of business cards.

Supporting recognition in both video streaming and photo taking modes.

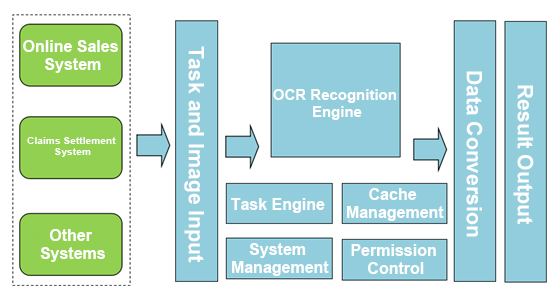

Server-side OCR Recognition Technology

Server-side OCR recognition technology based on self-developed OCR recognition technology, with accurate recognition rate and excellent recognition speed, OCR recognition technology supports automatic recognition of images obtained through scanners, cell phones, high-frequency cameras, cameras and other acquisition devices, support for a variety of card recognition:

Support second generation ID card, business card, bank card, driver's license, driving license, passport, Hong Kong and Macao Travel Permit and other domestic more than 20 kinds of commonly used documents recognition, at the same time can increase the types of documents according to customer demand.

Program Advantages

Reduces the number of manual entry, reduces cost investment and saves a lot of human, material and financial resources;

Enhances the speed of entry, improves the business processing time, and enhances customer satisfaction

Reduce the error rate, improve the quality of entry, reduce the problems occurring in the later operation, and improve the quality of service

It can be further expanded to provide a variety of automation references to optimize the business processing process, providing multi-faceted support for business operations.

Application Fields

Mobile underwriting

Online Sales System

Mobile Survey

Customer Premium Withholding

Successful Cases